Navigating the Waves of Market Volatility…Again

Explore the interplay of rising bond yields, volatile tech stocks, and robust retail sales as we dissect the implications for future Federal Reserve actions.

Market’s Ascent Halted by Inflation’s Gravitational Pull

“Global markets await a tapestry of economic cues, with vigilant eyes on policy decisions and corporate health this week.”

Markets’ Euphoric Spell Dampened as the Federal Reserve Ponders its Next Move

Market dynamics shift as tech retreats and gold climbs; investors weigh corporate maneuvers amid regulatory challenges and economic recalibration

Wall Street Wavers as It Weighs Fed’s Resolve Against Economic Zeal

Powell’s pivotal testimony looms as markets waver; tech titans sway stocks while bonds and Bitcoin chart an uncertain course.

Yield Curves Whisper: Deciphering the Grand Ballet of Financial Markets for Retail Investors

In the grand symphony of finance, every move—from Fed cues to bond auctions—plays into the intricate dance of market dynamics.

Market Sentinels on Alert: Option Traders Hedge Against Fed’s Next Move Amidst Economic Crosswinds

Traders brace for potential Fed pivot, hedging bets amid mixed signals and global economic intricacies—caution reigns in uncertain times.

Market Vigilance Amidst Triumph: S&P 500’s Unprecedented Surge Against a Backdrop of Monetary Equilibrium

In the day’s recap, the S&P 500’s steadiness contrasts with a slight decline in the Nasdaq and a modest uptick in the Dow, reflecting a market in contemplation. Currency stability suggests investors are holding their breath for the week’s revelations, and Bitcoin’s surge past $50,000 alongside Ether’s gains indicates a robust appetite for digital assets.

Adjusting Your Portfolio in the Wake of S&P’s Skyward Sprint

In the world of investing, the only constant is change, and the recent meteoric rise of the S&P 500 is a clarion call for investors to re-examine and potentially adjust their portfolios. The index’s sprint beyond the 5,000 mark is not just a headline-grabbing event—it’s a harbinger of market shifts that prudent investors would do

Markets Soar as S&P 500 Breaches the 5,000 Mark: A New Chapter in Economic Optimism

S&P hits 5,000 amid corporate shake-ups and crypto climbs, signaling a strategic moment for savvy, diversified portfolio adjustments.

The Cash Conundrum: Market Volatility and the Illusion of Safety

When facing market volatility, many investors instinctively retreat to the perceived safety of cash. However, we argue that this move isn’t always as prudent as it seems. Amid current inflation rates, cash holdings can suffer significant purchasing power erosion. Furthermore, holding onto cash can mean missing out on potential returns from other asset classes. Instead of a knee-jerk flight to cash, we advocate for a long-term perspective and diversified portfolio strategy, warning that the safety of cash can be an illusion, potentially leading investors to lost opportunities and diminished purchasing power.

In the world of investing, the only constant is change, and the recent meteoric rise of the S&P 500 is a clarion call for investors to re-examine and potentially adjust their portfolios. The index’s sprint beyond the 5,000 mark is not just a headline-grabbing event—it’s a harbinger of market shifts that prudent investors would do

S&P 500 stays above 5,000, defying expectations. Investors ponder economic principles amid market highs and evolving Federal Reserve rate strategies, but finishes on a downward trend.

Markets rally on robust job growth and tech gains, challenging Fed rate cut expectations amid economic strength and policy complexity.

The Federal Reserve, led by Jerome Powell, maintains interest rates, signaling a cautious approach to achieving a sustainable inflation target amidst economic uncertainties. Powell’s emphasis on patience underscores a commitment to long-term financial stability.

In a symphonic week of market oscillations, the steadfast conductor Federal Reserve wielded a higher-for-longer baton, eliciting a cacophony from actors such as Treasuries, tech, and traders, all playing their parts amidst the shadows of inflation fears and the unwavering scripts of policy paths.

In a symphonic rendition of economic developments, Wall Street finds itself in a tumultuous dance of derivatives and unrest, where titans stumble and unexpected players rise, painting a vivid tableau of a market at the crossroads, awaiting the conductor’s decisive baton in a landscape rich with both peril and promise.

Amid regulatory shake-ups and economic recovery puzzles, Wall Street navigates the tumult, with fortune favoring the bold.

Wall Street’s rally recoups losses, with investors mired in uncertainty over the trajectory of future interest rates.

Apple’s ascent amid market ebbs and flows exemplifies big tech resilience, even as market optimism toes a delicate line.

Technology stocks, have shouldered the S&P 500 further into bull market territory, yet the parade might soon encounter roadblocks with looming central bank decisions and the unexpected political drama revolving around a former president.

Amidst the undulating market landscape, tech volatility, oil’s back-and-forth, and the Fed’s inscrutable stance underpin an air of uncertainty, all the while observed by the steadfast gaze of the dollar.

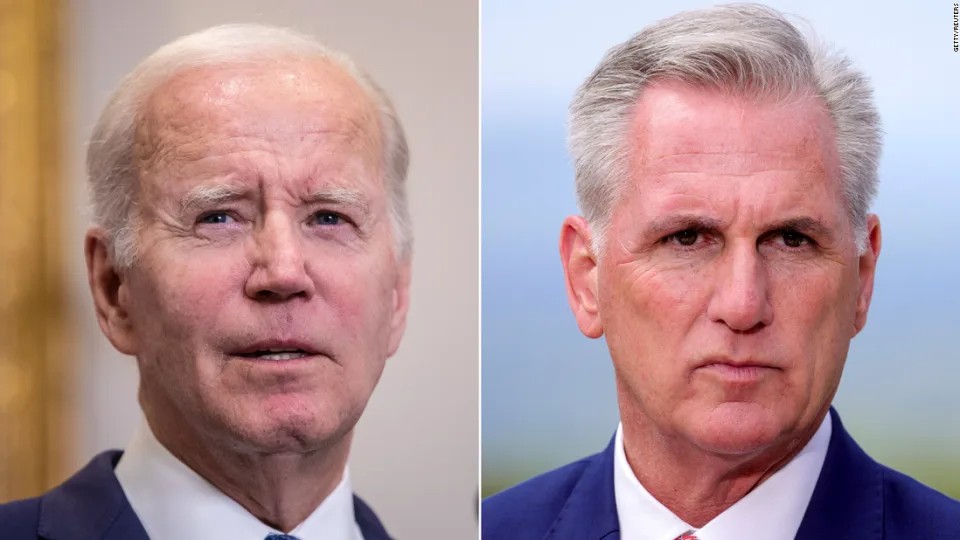

In an economic ballet, President Biden maneuvers a debt-limit deal to sidestep fiscal calamity while the market, drunk on tech-fueled gains, teeters on the edge of an exuberant bull run, creating a perplexing dichotomy between Wall Street euphoria and the specter of national debt.

Photo: Anna Rose Layden/Getty Images/David Swanson/Reuters

In the grip of data deluge and policy discourse, global markets teeter on the precipice of uncertainty, balanced between hope and apprehension as they navigate a sea of manufacturing indices, employment statistics, inflation concerns, and the curious dance of stocks and bonds.

In the grand ballroom of market dynamics, we’re confronted with a treasuries tango, an intricate dance-off between yields and the US debt ceiling, setting the stage for a tense, uncertain spectacle filled with political wrangling and investor anxiety.

As global markets reel from a deadlock in US debt-ceiling talks, surging UK inflation, and worries over China’s economy, the upcoming week presents a challenging tableau of potential interest rate hikes and financial uncertainties.

Latest Market News